Tds On Commission And Brokerage 2024-24

Tds On Commission And Brokerage 2024-24. Similarly, section 194h (payment of commission or. Under section 194t, if you receive salary, commission, bonus, or interest exceeding rs.

Any entity (excluding individuals or hindu undivided families) responsible for paying residents any. Tax deduction at source (tds) now at.

Tds On Commission And Brokerage 2024-24 Images References :

Source: www.taxbuddy.com

Source: www.taxbuddy.com

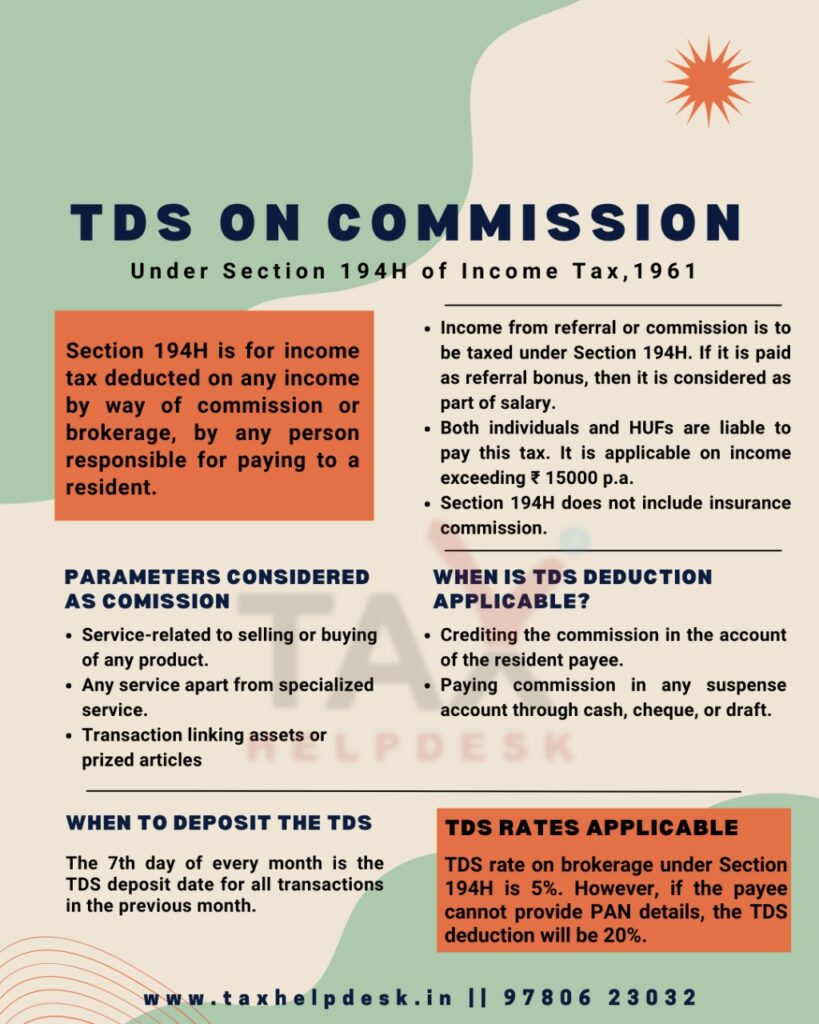

Section 194H TDS on Commission and Brokerage Explained, Similarly, section 194h (payment of commission or.

Source: leolaywendeline.pages.dev

Source: leolaywendeline.pages.dev

Tds On Commission 202425 Ambur Serene, Similarly, section 194h (payment of commission or.

Source: khatabook.com

Source: khatabook.com

Section 194H Details about TDS on Commission and Brokerage, This reduction benefits individuals or entities who receive commission or brokerage, particularly in industries such.

Source: www.taxhelpdesk.in

Source: www.taxhelpdesk.in

Section 194H TDS on Commission and Brokerage TaxHelpdesk, Comprehensive tds rate chart for various nature of payments.

Source: elayneylucienne.pages.dev

Source: elayneylucienne.pages.dev

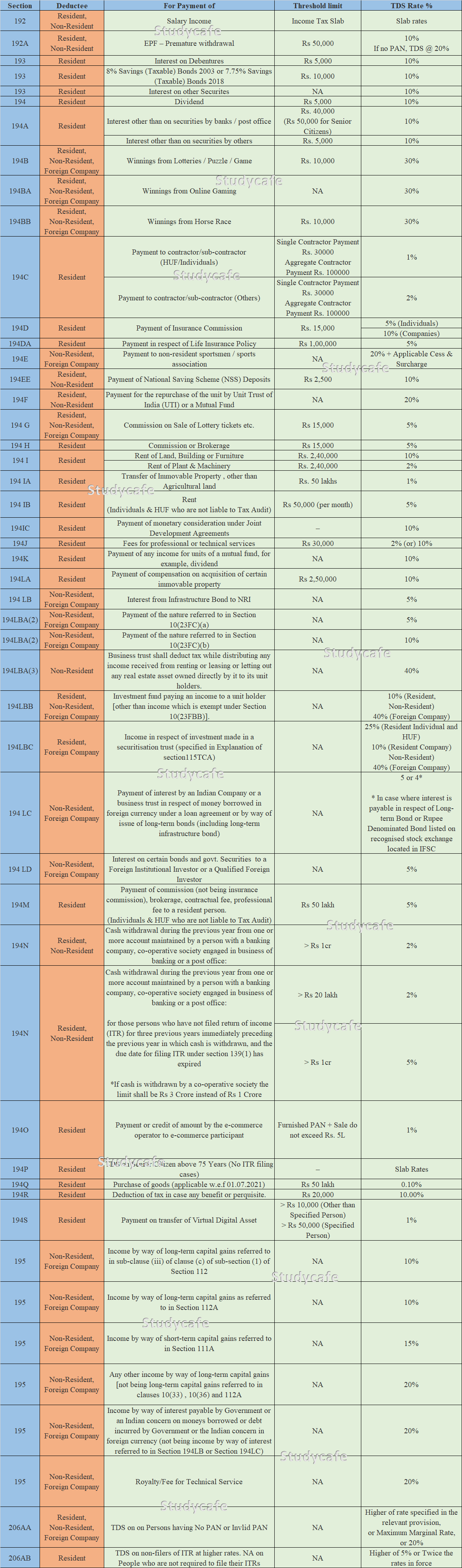

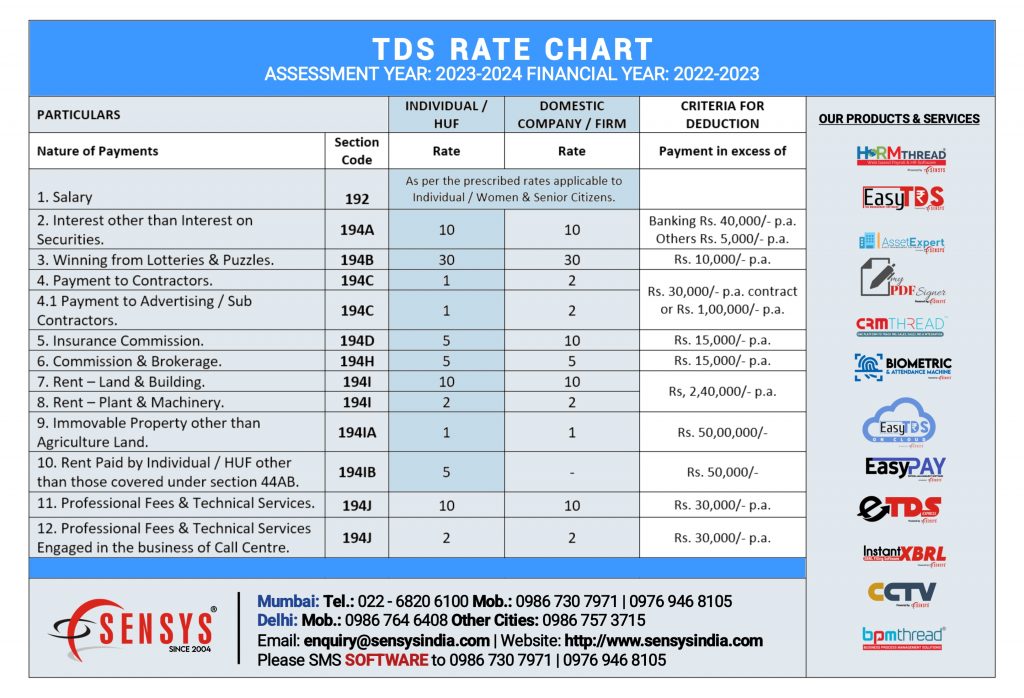

Tds On Commission 202424 Limit Joell Madalyn, A tds (tax deducted at source) chart, also known as a tds section chart, is a reference tool that provides a comprehensive overview of the applicable tds rates for.

Source: elayneylucienne.pages.dev

Source: elayneylucienne.pages.dev

Tds On Commission 202424 Limit Joell Madalyn, Tds rates are changed by budget 2024 via finance act (no.2) 2024 for f.y.

Source: elayneylucienne.pages.dev

Source: elayneylucienne.pages.dev

Tds On Commission 202424 Limit Joell Madalyn, In the union budget 2024, the indian government announced changes to tds (tax deducted at source) rates for various sections, effective from october 1, 2024.

Source: elayneylucienne.pages.dev

Source: elayneylucienne.pages.dev

Tds On Commission 202424 Limit Joell Madalyn, In the union budget 2024, the indian government announced changes to tds (tax deducted at source) rates for various sections, effective from october 1, 2024.

Source: blogs.jrcompliance.com

Source: blogs.jrcompliance.com

TDS on Brokerage and Commission Section 194H JR Compliance, In the union budget 2024, the indian government announced changes to tds (tax deducted at source) rates for various sections, effective from october 1, 2024.

Source: leolaywendeline.pages.dev

Source: leolaywendeline.pages.dev

Tds On Commission 202425 Ambur Serene, Similarly, section 194h (payment of commission or.

Posted in 2024